Uncover the Cost-Effective Benefits of Offshore Company Formation for Your Startup.

Uncover the Cost-Effective Benefits of Offshore Company Formation for Your Startup.

Blog Article

Offshore Firm Formation: Just How to Build a Strong International Business Structure

Offshore firm formation offers a calculated chance for entrepreneurs looking for to enhance their worldwide business framework while enhancing tax obligation benefits and securing possessions. Choosing the ideal jurisdiction is critical, as it can substantially affect the legal and operational landscape of the organization. Navigating the intricacies of conformity, banking relationships, and growth approaches requires cautious factor to consider and expertise. Comprehending these fundamental aspects can be critical, yet many neglect crucial elements that can fundamentally modify their success in the global market. What are the important aspects that could open the complete possibility of your overseas venture?

Comprehending Offshore Companies

The formation of an offshore business often needs conformity with particular lawful frameworks that differ by territory. This process normally involves picking a suitable company framework-- such as a firm or limited obligation business-- and meeting regulatory needs, including registration and annual coverage.

Offshore firms can additionally benefit from positive governing settings, including lower taxation rates and streamlined service procedures. Several territories offer confidentiality provisions that safeguard the identities of shareholders and directors, which can be appealing for individuals seeking discernment in their economic ventures. Inevitably, recognizing the distinctive characteristics of offshore firms is important for individuals and companies wanting to leverage international markets properly while navigating the complexities of international business.

Selecting the Right Jurisdiction

Choosing the best jurisdiction is a crucial action in offshore firm development, as it can substantially influence the benefits and functional efficiency of the company. Various variables have to be taken into consideration when making this decision, consisting of tax effects, governing setting, and the political stability of the territory.

Tax obligation benefits are often a key incentive in picking an overseas place. Some territories supply desirable tax rates or also tax obligation exemptions for foreign-owned companies, which can bring about considerable financial savings. Furthermore, the ease of operating, consisting of the performance of company enrollment procedures and the accessibility of specialist solutions, plays an essential duty.

Furthermore, the lawful structure and administrative demands in a territory can vary commonly, influencing operational versatility. Territories with strong privacy regulations may likewise attract those seeking personal privacy for their organization activities.

Legal Demands and Compliance

Usually, offshore firms have to investigate this site assign a signed up representative, preserve a registered workplace, and data annual returns or economic declarations. Some jurisdictions may additionally impose minimum resources demands or particular organization licenses depending on the sector. Abiding by anti-money laundering (AML) and know-your-customer (KYC) guidelines is also essential to avoid financial misbehavior and maintain compliance with worldwide criteria.

Moreover, comprehending tax commitments, including any check my reference type of appropriate withholding taxes and material requirements, is crucial. Many territories have passed measures to inhibit tax evasion, and failing to comply can cause extreme fines. Involving with regional legal professionals can help browse these intricacies and guarantee that all commitments are met, promoting a durable structure for your overseas business. In recap, attentive attention to lawful needs is vital for effective overseas business development.

Banking and Monetary Factors To Consider

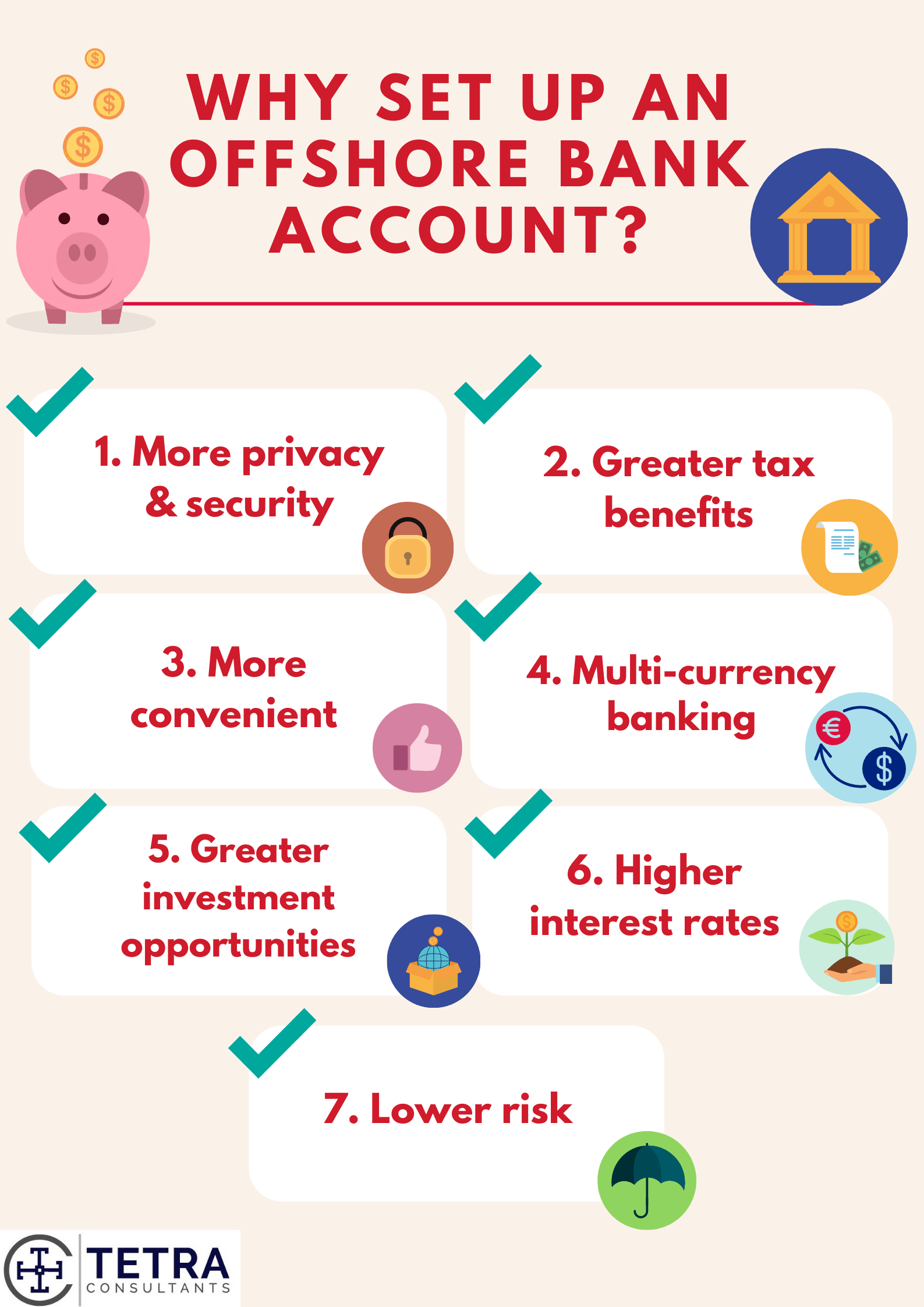

Establishing a robust financial framework is a critical aspect of offshore business formation, as it straight influences financial operations and availability to international markets. Picking the right banking jurisdiction is necessary, as it influences not just the ease of transactions yet also compliance with worldwide regulations. Various jurisdictions provide unique advantages, such as beneficial tax obligation plans and privacy securities, which can dramatically boost functional effectiveness.

When opening offshore savings account, companies must give comprehensive documentation, consisting of proof of identity, business enrollment, and a detailed organization strategy. This persistance assists reduce the risks connected with cash laundering and various other monetary criminal activities, guaranteeing that the banking partnership is both safe and compliant.

Additionally, understanding the currency and purchase capabilities of the picked financial institution is vital. Companies ought to assess whether the bank supplies multi-currency accounts, electronic banking centers, and competitive charges for worldwide transactions.

Lastly, normal communication with banking representatives can facilitate smoother procedures and provide understandings into evolving economic guidelines. Learn More By prioritizing these banking and economic considerations, businesses can lay a solid structure for their offshore procedures, consequently enhancing their international reach and monetary stability.

Approaches for Sustainable Development

While many services focus on immediate economic gains, establishing methods for lasting growth is essential for lasting success in the affordable landscape of offshore business development - offshore company formation. Establishing a robust structure involves branching out revenue streams, making sure that the business is not extremely reliant on a solitary market or item. This can be achieved by expanding solution offerings or exploring new geographic markets

In addition, buying modern technology and infrastructure is critical. Leveraging digital tools can improve functional performance, streamline processes, and enhance client involvement. This not just minimizes prices yet also positions the company to react swiftly to changing market conditions.

Building strong partnerships with regional entities and leveraging their competence can better facilitate growth. These relationships can offer useful understandings right into market dynamics and help navigate regulative atmospheres much more effectively.

Conclusion

In summary, offshore firm development offers a viable method for developing a robust international company structure. By thoroughly picking favorable territories and sticking to legal requirements, services can optimize tax obligation performance and improve possession protection. Furthermore, promoting solid financial connections and implementing strategies for lasting development can bring about varied income streams. Ultimately, a well-structured offshore entity not only promotes operational flexibility yet also placements ventures for success in the significantly affordable global market.

Report this page